How to improve credit score in India 2024

Low credit score can often lead to rejection of credit card applications. In this post we will explore various driving factors which can help you to improve credit score.

Table of Contents

On time payments

If you are consistently paying on time, it will eventually increase your credit score over time. If you miss one, the score can significantly decrease.

Spend less than your credit limit

If you are a high spender and always touching your limit (in terms of spends), you need to calm down! A 30% utilization of your credit limit is ideal and helps to maintain your credit score.

Monitor Credit Report regularly

Regularly monitoring your credit report helps you to see what was the moving factor for any significant changes in score and you can remediate that. It also helps you to see if there is any unknown usage related to your PAN card.

Credit applications

Do not apply for multiple credit cards within a short period of time as that results is huge queries on your credit report. This is one of the driving factor for some banks to issue a credit card.

Example: I was rejected for Scapia Credit Card as I had more than 6 credit inquiries in last 6 months

Credit Card Age

If you have credit cards which are old (2-3 years or more), they have a good impact on your credit score and eventually helps in increasing your score.

Auto-Payments

This is not exactly a driving factor, but a simple hack to pay your bills on time. You can setup auto payments for your loans and credit cards which helps to avoid late payment. This also saves you late payment fees.

Reducing Credit Accounts

Early paying of loans also demonstrates good credit discipline and might help in improving score.

Secured Credit Card

Individuals with low credit score or no credit history with multiple rejections, can look to apply for secured Credit Cards backed by Fixed Deposits (FDs). This is a good way to rebuild credit reputation.

Conclusion

The above suggestions have been known to improve credit score in India. Thus, by following these suggestions, you might be benefited for same.

FAQs

Does having too many credit cards affect my credit score?

If you apply for too many credit cards in a short period of time, that might impact your score. Over a long, period it shouldn’t matter.

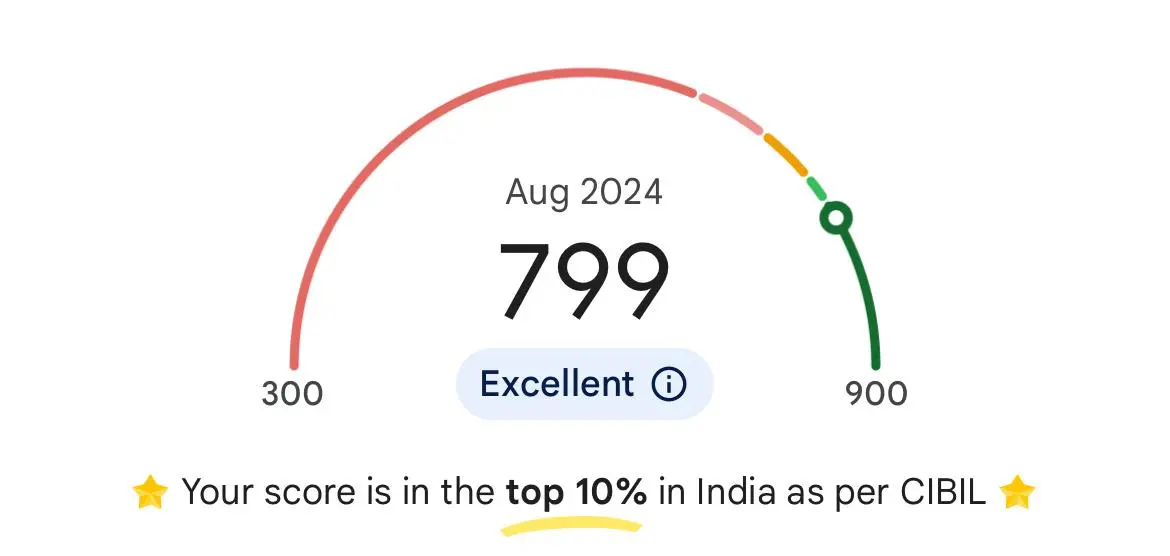

What credit score is considered as good?

Credit score above 700 is considered as good.

Why did my credit score decrease?

There are multiple factors which leads to fall in credit score like late payment, over utilization of credit limit, etc.

How to check credit score for free?

There are multiple apps which provide free credit score check: GPay, Cred, TataNeu, OneScore, etc.